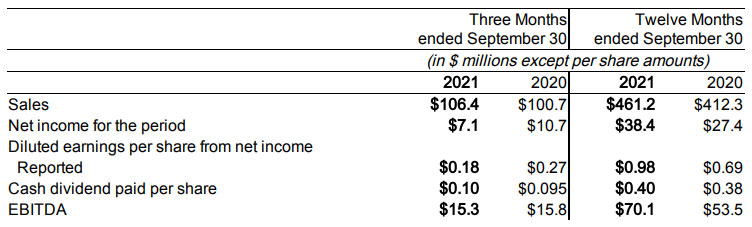

- Sales of $106.4 million for the quarter and $461.2 million for the year

- EPS of $0.18 for the quarter and $0.98 for the year

- EBITDA of $15.3 million and EBITDA margin 14.4% in the quarter

- Free Cash Flow of $37.3 million or $0.95 per share in Fiscal 2021

- Balance sheet in a $18.6 million net cash position

TORONTO, Dec. 01, 2021 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX-XTC, OTCQX-EXCOF) today announced results for its fourth quarter and year ended September 30, 2021. In addition, the Company announced the quarterly dividend of $0.10 per common share which will be paid on December 31, 2021 to shareholders of record on December 17, 2021. The dividend is an “eligible dividend” in accordance with the Income Tax Act of Canada.

“Exco completed the final quarter of fiscal 2021 with relatively strong results despite a very challenging environment,” said Darren Kirk, Exco’s President and CEO. “We expect to build on this momentum in the year ahead as industry conditions normalize and recent program launches are fully ramped up. Longer term, our businesses will experience a continuing tailwind from the electric vehicle revolution and worldwide movement towards reducing emissions.”

Fourth quarter consolidated sales were $106.4 million – an increase of $5.7 million or 6% from the prior year. During the quarter, exchange rate movements decreased sales by $5.0 million.

The Automotive Solutions segment experienced a 7% decrease in sales, or a reduction of $4.4 million, to $56.8 million from $61.2 million in the fourth quarter of 2020. Excluding the impact of foreign exchange, segment sales decreased $1.4 million or 2%. The sales decline was driven by materially lower vehicle production volumes in both North America and Europe due to supply chain disruptions including semiconductor chip shortages and logistical constraints. North American vehicle production was down 25% during the quarter compared to a year ago and European vehicle production was down about 30%. The segment’s very modest top line decline in the context of this environment reflects the benefits of sizeable new program launches and favorable product mix, particularly at the segment’s Polytech and Neocon operations. Looking forward, OEM vehicle production volumes are expected to increase as the semiconductor chip availability improves. Exco will benefit from this development as well as the restocking of certain accessory products and higher volumes arising from new/ recent program launches. Quoting activity remains encouraging and we see ample opportunity to maintain our longer-term trend of increasing our content per vehicle across our portfolio of businesses.

The Casting and Extrusion segment recorded sales of $49.6 million in the fourth quarter compared to $39.5 million last year – an increase of $10.1 million or 26%. Excluding the negative impact of foreign exchange movements, the segment’s sales were up 31% for the quarter. The Extrusion group experienced higher sales at all locations, reflecting pricing action, increased demand for extrusion tools across all industry segments and operational improvements that have continued to reduce lead times contributing to market share gains. The Castool group’s revenues were higher for the quarter as demand for die-cast consumable tooling and extrusion products was solid, with a slightly stronger demand for the die-cast consumable tooling solutions leading the quarter. Castool growth was driven by increasing electric vehicle production which compensated for lower overall industry vehicle production. Castool continues to invest in new equipment and advance its proprietary tooling solutions which are increasingly required by customers as their manufactured components increase in size and complexity and as they focus on improving their own productivity and efficiency. The Large Mould group sales were up 34% from the prior year quarter with a mixture of new tools, die rebuilds and solid additive sales representing key drivers of the results. New business from current and new customers was awarded in the quarter; as a result, inventories and backlog continue to grow. Looking forward, quoting activity within all groups in this segment is strong and will benefit as automotive production rebounds.

The Company’s fourth quarter consolidated net income decreased to $7.1 million or earnings of $0.18 per share compared to $10.7 million or earnings of $0.27 per share in the same quarter last year – an EPS decrease of 33%. The effective income tax rate was 27% in the current quarter compared to negative 3% in the same quarter last year. The effective tax rate in the current period reflects the impact of non-taxable expenses in foreign jurisdictions and the payment of franchise and state taxes. The tax rate in the prior year quarter reflects the reversal of $2.3 million of deferred tax liabilities from resolved tax exposures and $0.3 million of R&D tax credits net of certain foreign tax adjustments. Excluding these items, the effective tax rate was 22% in the prior year quarter.

Fourth quarter pre-tax earnings in the Automotive Solutions segment totalled $4.5 million, a decrease of $2.8 million or 38% over the same quarter last year. Included in the prior year quarter was COVID-19 wage subsidies of $1.3 million. Current period profitability was negatively impacted by lower sales volumes and higher costs associated with the semiconductor shortage, which negatively impacted our ability to manage operations efficiently. In particular, order flow across most products was erratic as OEMs constantly reshuffled their own production schedules while our labour other overhead items were geared to a higher level of sales. As well, logistical challenges created increased expedite charges in some cases, we faced raw material cost inflation and also incurred severance costs. Management is optimistic that its overall cost structure will return to relatively normal levels in future quarters as scheduling and predictability improves with strengthening volumes.

Pre-tax earnings in the Casting and Extrusion segment improved by $1.7 million or 40% over the same quarter last year to $5.9 million. Excluding $2.7 million in COVID-19 subsidies received last year, segment profitability improved by $4.4 million. The earnings improvement was mainly driven by increased contributions from the Extrusion group. This group benefited from higher volumes and prices. Direct labour as a function of sales improved and fixed overheads were better absorbed. While higher sales at the Castool and Large Mould groups also positively impacted segment profitability, this benefit was countered by rising raw material prices, cost overruns with certain programs near completion and initial expenses for Castool’s new plant in Morocco.

The Corporate segment in the fourth quarter recorded expenses of $0.7 million compared to $1.1 million last year mainly due to foreign exchange gains in the current quarter compared to losses in the prior year period, partially offset by higher compensation expenses incurred in the current quarter. As a result of the foregoing, consolidated EBITDA in the quarter was $15.3 million (14.4% of sales) compared to $15.8 million (15.7% of sales) last year.

Exco generated cash from operating activities of $7.3 million during the quarter and $3.2 million of Free Cash Flow after $4.0 million in Maintenance Fixed Asset Additions. This cash flow, together with cash on hand was more than sufficient to fund fixed assets for growth initiatives of $7.7 million and $3.8 million of dividends. For the year, Exco generated Free Cash Flow of $37.3 million and returned $15.5 million to shareholders through dividend payments. Exco ended the year with $18.6 million in net cash and $68.6 million in available liquidity, including $24.1 million of balance sheet cash, continuing its practice of maintaining a very strong balance sheet and liquidity position.

For further information and prior year comparison please refer to the Company’s Fourth Quarter Condensed Financial Statements in the Investor Relations section posted at www.excocorp.com. Alternatively, please refer to www.sedar.com.

Non-IFRS Measures: In this News Release, reference may be made to EBITDA, EBITDA Margin, Pretax Profit, Free Cash Flow and Maintenance Fixed Asset Additions which are not measures of financial performance under International Financial Reporting Standards (“IFRS”). Exco calculates EBITDA as earnings before interest, taxes, depreciation, amortization and other expenses and EBITDA Margin as EBITDA divided by sales. Exco calculates Pretax Profit as segmented earnings before other income/expense, interest and taxes. Free Cash is calculated as cash provided by operating activities less interest paid and Maintenance Fixed Asset Additions. Maintenance Fixed Asset Additions represents investment in fixed assets that are required to continue current capacity levels. EBITDA, EBITDA Margin, Pretax Profit and Free Cash Flow are used by management, from time to time, to facilitate period-to-period operating comparisons and we believe some investors and analysts use these measures as well when evaluating Exco’s financial performance. These measures, as calculated by Exco, do not have any standardized meaning prescribed by IFRS and are not necessarily comparable to similar measures presented by other issuers. Given the Company’s elevated planned capital spending on fixed assets for growth initiatives (including additional Greenfield locations, energy efficient heat treatment equipment and increased capacity) through the near term, the Company has modified its calculation of Free Cash Flow. This change is meant to enable investors to better gauge the amount of generated cash flow that is available for these investments as well as acquisitions and/or returns to shareholders in the form of dividends or share buyback programs.

Quarterly Conference Call: December 2, 2021 10:00 a.m.(Toronto time)

To access the live audio webcast, please log on to www.excocorp.com, or https://edge.media-server.com/mmc/p/n8go7q8w a few minutes before the event. The conference call can be accessed by dialing toll free at (866) 572-8261 or internationally at (703) 736-7448. The conference ID is 5082034.

For those unable to participate on December 2, 2021, an archived version will be available on the Exco website.

About Exco Technologies Limited:

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 16 strategic locations in 7 countries, we employ about 4,900 people and service a diverse and broad customer base.

Notice To Reader: Forward Looking Statements

This press release contains forward-looking information and forward-looking statements within the meaning of applicable securities laws. We may use words such as “anticipate”, “may”, “will”, “should”, “expect”, “believe”, “estimate”, “5-year target” and similar expressions to identify forward-looking information and statements especially with respect to growth, outlook and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions, liquidity, operating efficiencies, improvements in, expansion of and/or guidance or outlook as to future revenue, sales, production sales, margin, earnings, earnings per share, including the outlook for 2026, are forward-looking statements. These forward-looking statements include known and unknown risks, uncertainties, assumptions and other factors which may cause actual results or achievements to be materially different from those expressed or implied. These forward-looking statements are based on our plans, intentions or expectations which are based on, among other things, the current improving global economic recovery from the COVID-19 pandemic and containment of any future or similar outbreak of epidemic, pandemic, or contagious diseases that may emerge in the human population, which may have a material effect on how we and our customers operate our businesses and the duration and extent to which this will impact our future operating results, assumptions about the number of automobiles produced in North America and Europe, production mix between passenger cars and trucks, the number of extrusion dies required in North America and South America, the rate of economic growth in North America, Europe and emerging market countries, investment by OEMs in drivetrain architecture and other initiatives intended to reduce fuel consumption and/or the weight of automobiles in response to rising climate risks, raw material prices, supply disruptions, economic conditions, inflation, currency fluctuations, trade restrictions, our ability to integrate acquisitions, our ability to continue increasing market share, or launch of new programs and the rate at which our current and future greenfield operations in Mexico and Morocco achieve sustained profitability. Readers are cautioned not to place undue reliance on forward-looking statements throughout this document and are also cautioned that the foregoing list of important factors is not exhaustive. The Company will update its disclosure upon publication of each fiscal quarter’s financial results and otherwise disclaims any obligations to update publicly or otherwise revise any such factors or any of the forward-looking information or statements contained herein to reflect subsequent information, events or developments, changes in risk factors or otherwise. For a more extensive discussion of Exco’s risks and uncertainties see the ‘Risks and Uncertainties’ section in our latest Annual Report, Annual Information Form (“AIF”) and other reports and securities filings made by the Company. This information is available at www.sedar.com or www.excocorp.com.