Interim Report to the Shareholders

For the Nine Months Ended June 30, 2021

3rd Quarter 2021

Interim Report to the Shareholders

For the Nine Months Ended June 30, 2021

TORONTO, July 28, 2021 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX-XTC) today announced results for its third quarter of fiscal 2021 ended June 30, 2021. In addition, Exco announced a quarterly dividend of $0.10 per common share which will be paid on September 30, 2021 to shareholders of record on September 16, 2021. The dividend is an “eligible dividend” in accordance with the Income Tax Act of Canada.

“Exco achieved very strong results again this quarter while making tremendous progress advancing our numerous growth initiatives, said Darren Kirk, Exco’s President and CEO. “We are targeting a greater than 50% increase in revenue and net income over the next five years while making a positive contribution to global sustainability goals. In particular, the accelerating adoption of the electric vehicle is a guiding driver behind our capital commitments, business objectives and where market forces align perfectly with our competitive advantages. We have never been more excited for the future”, added Kirk.

Consolidated sales for the third quarter ended June 30, 2021 were $115.0 million compared to $71.0 million in the same quarter last year – an increase of $44.0 million, or 63%. Excluding foreign exchange rate fluctuations sales increased 78% during the quarter.

The Automotive Solutions segment reported sales of $61.0 million in the third quarter – an increase of $32.9 million, or 117% from the prior year quarter. Excluding foreign exchange rate movements, segment revenues would have been $67.2, or up 139% for the quarter. This strong sales growth reflects a normalization of activities compared to the prior year when 3 of our 4 manufacturing plants in this segment were shut down for April and much of May due to COVID-19 government restrictions. Notwithstanding this improvement, growth in the current year periods was hampered by the global microchip supply issues, which management estimates reduced vehicle production volumes and segment sales by between 15% to 20% in the quarter. Segment sales were supported by a number of key program launches for both new and existing products and favourable vehicle mix. The segment received several contract wins during the quarter and management continues to see decent quoting activities for new programs across the segment’s various businesses supporting future growth.

The Casting and Extrusion segment reported sales of $53.9 million for the third quarter – an increase of $11.1 million, or 26%, from the same period last year. Excluding the negative impact of foreign exchange movements, the segment’s sales were up 37% for the quarter and continue to exceed pre-COVID-19 levels. Although the impact of the microchip shortage was not as significant in the Casting and Extrusion segment as it was in the Automotive segment, sales in the Castool and Large Mould groups were negatively impacted from certain customers during the quarter and year-to-date. Third quarter segment sales reflect the third consecutive quarterly increase (10% over F2021 Q2) even with the negative impact of foreign exchange and the microchip issues. The Extrusion group experienced higher sales at all locations, reflecting demand for extrusion tools across all industry segments particularly in the building sector coupled with operational improvements that have continued to reduce lead times contributing to market share gains. At Castool, the group’s revenues were higher for the quarter. Demand for Castool’s die-cast consumable tooling and extrusion products was solid, with a slightly stronger demand for the die-cast consumable tooling solutions leading the quarter. Castool continues to invest heavily in new equipment and advance its proprietary tooling solutions which are increasingly required by customers as their manufactured components increase in size and complexity while they focus on improving their own productivity and efficiency measures. The Large Mould group sales were up 31% from F2021 Q2 with diversity of its customer base and solid additive sales representing key drivers of the results. New business from current and new customers was awarded in the quarter; as a result, inventories and backlog continue to grow.

Consolidated net income for the third quarter was $8.7 million or basic and diluted earnings of $0.22 per share compared to a loss of $0.8 million or $0.02 loss per share in the same quarter last year – an increase in net income of $9.5 million. The consolidated effective income tax rate of 12% in the current quarter compared to 10% in the prior year period. The income tax rate in the current quarter and year was favorably impacted by the recognition of Scientific Research and Experimental Development income tax credits during the quarter.

The Automotive Solutions segment reported pre-tax profit of $5.1 million in the third quarter compared to a loss of $3.8 million in the same quarter last year – an increase of $8.9 million. The segment’s profitability growth reflects three months sales compared to the plant shutdowns in the prior year due to COVID-19. Overall profit margins were lower than expected due to decreased fixed cost absorption from lower sales as a result of the microchip shortage and raw material price increases due to inflationary pressures experienced in most inputs but particularly resin. As well, supply issues persisted across the segment resulting in significant inefficiencies and much higher freight/ transportation costs. Management remains focused on improving the efficiency of its operations and reducing its overall cost structure. Pricing discipline also remains a focus and new program awards include management’s expectations for higher future costs.

The Casting and Extrusion segment reported $7.8 million of pre-tax profit in the third quarter – an increase of $2.8 million or 57% from the same quarter last year. Similar to the Automotive segment, the Casting and Extrusion segment profitability growth over the prior year periods is a result of higher sales due to the impact of COVID-19 last year. This impact, however, was somewhat muted last year by the nature of much of the segment’s tooling products as they feed into many essential industries. Consistent with the higher third quarter sales, segment profitability continued to improve. Quarterly segment pre-tax profit was 5% higher than F2021 Q2 profit. In addition, fixed cost absorption improved and we benefited from greater labour efficiencies reflecting our past and continuing investments in new equipment and processes, as part of our continuous improvement initiatives. These improvements were partially offset by higher freight and raw material input costs.

The Corporate segment expenses were $2.8 million in the second quarter compared to $1.9 million in the prior year quarter. Corporate expenses increased in the quarter due to foreign exchange losses relating to the strengthening Canadian dollar compared to prior periods and increased incentive expenses.

Consolidated EBITDA for the third quarter totaled $15.2 million compared to $4.7 million in the same quarter last year – an increase of $10.5 million. EBITDA as a percentage of sales increased to 13.2% in the current quarter compared to 6.6% the prior year quarter driven by an improvement in the Automotive Solutions segment (11% compared to negative 7%) and Casting & Extrusion segment (21% compared to 20%).

Operating cash flow before net change in non-cash working capital totaled $13.9 million in the third quarter. After changes in working capital requirements, net cash provided by operating activities amounted to $19.0 million. This cash flow, together with cash on hand was more than sufficient to fund $0.1 million of interest expense, $16.7 million of capital expenditures, and $3.9 million of common dividend payments.

As at June 30, 2021, Exco’s consolidated balance sheet had net cash of $26.3 million. Principal sources of liquidity include generated Free Cash Flow, $34.9 million of balance sheet cash and $41.4 million of unused availability under its $50 million committed credit facility, which matures February 2023. Pursuant to the terms of the credit facility, Exco is required to maintain compliance with certain financial covenants, which the Company was in compliance with as at June 30, 2021.

Outlook

The overall outlook is very favorable across Exco’s various businesses. Consumer demand for automotive vehicles is currently outstripping supply in most markets, constrained by a shortage of microchips and to a lesser extent other raw materials and components. Dealer inventory levels are now near record lows, while average transaction prices are at record highs and the average age of the broader fleet has continued to increase to an all-time high. This bodes well for higher levels of future vehicle production and the sales opportunity of Exco’s various automotive components and accessories once supply chains normalize. In addition, OEM’s are increasingly looking to the sale of higher margin accessory products as a means to enhance their own levels of profitability. Exco’s Automotive Solutions segment derives a significant amount of activity from such products and is a leader in the prototyping, development and marketing of the same. Moreover, the rapid movement towards an electrified fleet is enticing new market entrants into the automotive market while causing traditional OEM incumbents to further differentiate their product offerings, all of which is driving above average opportunities for Exco.

With respect to Exco’s Casting and Extrusion segment, the intensifying global focus on environmental sustainability is creating significant growth drivers that are expected to persist through at least the next decade. Automotive OEMs are looking to light-weight metals such as aluminum to reduce vehicle weight and reduce carbon dioxide emissions. This trend is evident regardless of powertrain design – whether internal combustion engines, electric vehicles or hybrids. As well, a renewed focus on the efficiency of OEMs in their own manufacturing process is creating higher demand for advanced tooling that can contribute towards their profitability and sustainability goals. Tesla, in particular, has adopted the approach of utilizing much larger die cast machines to cast entire sub-frames of vehicles out of an aluminum based alloy rather than assemble numerous pieces of separately stamped and welded pieces of ferrous metal. Exco expects traditional OEMs will ultimately follow this trend and is positioning its operations to capitalize accordingly.

On the cost side, inflationary pressures have intensified in recent quarters while prompt availability of various input materials and components has become more challenging. We are offsetting these dynamics through various efficiency initiatives and taking pricing action where possible although there is typically several quarters of lag before the counter measures are evident.

Exco itself is also looking inwards with respect to ESG and sustainability trends to ensure its own operations are sustainable. We are investing significant capital to improve the efficiency of our own operations and lower our own carbon footprint. We expect to update the market on these initiatives over the coming quarters.

Over the next 5 years Exco is currently targeting a compounded average annual growth rate of approximately 10% for revenues and slightly higher levels for EBITDA and Net Income during this timeframe, producing an annual EPS of roughly $1.90 in fiscal 2026. This target is expected to be achieved through the launch of new programs, general market growth, and also market share gains consistent with the Company’s operating history. Capital investments will remain elevated in the next few years in order to position the Company for the significant growth opportunities we see. Capital expenditures are expected to exceed $40 million for fiscal 2021.

To review the Company’s third quarter financial statements and updated investor presentation please refer to the Company’s website at www.excocorp.com. Alternatively, please refer to www.sedar.com.

Non-IFRS Measures: In this News Release, reference may be made to EBITDA, EBITDA Margin, Pretax Profit, Free Cash Flow and Maintenance Fixed Asset Additions which are not measures of financial performance under International Financial Reporting Standards (“IFRS”). Exco calculates EBITDA as earnings before interest, taxes, depreciation, amortization and other expenses and EBITDA Margin as EBITDA divided by sales. Exco calculates Pretax Profit as segmented earnings before other income/expense, interest and taxes. Free Cash is calculated as cash provided by operating activities less interest paid and Maintenance Fixed Asset Additions. Maintenance Fixed Asset Additions represents investment in fixed assets that are required to continue current capacity levels. EBITDA, EBITDA Margin, Pretax Profit and Free Cash Flow are used by management, from time to time, to facilitate period-to-period operating comparisons and we believe some investors and analysts use these measures as well when evaluating Exco’s financial performance. These measures, as calculated by Exco, do not have any standardized meaning prescribed by IFRS and are not necessarily comparable to similar measures presented by other issuers. Given the Company’s elevated planned capital spending on fixed assets for growth initiatives (including additional Greenfield locations, energy efficient heat treatment equipment and increased capacity) through the near term, the Company has modified its calculation of Free Cash Flow. This change is meant to enable investors to better gauge the amount of generated cash flow that is available for these investments as well as acquisitions and/or returns to shareholders in the form of dividends or share buyback programs.

Quarterly Conference Call – July 29, 2021 at 10:00 a.m. (Toronto time):

To access the live audio webcast, please log on to www.excocorp.com, or https://edge.media-server.com/mmc/p/zmtr7qkc a few minutes before the event. The conference call can also be accessed by dialling toll free at (866) 572-8261 or internationally at (703) 736-7448. The conference ID is 8450289.

For those unable to participate on July 29 2021, an archived version will be available on the Exco website.

About Exco Technologies Limited:

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 16 strategic locations in 7 countries, we employ approximately 4,800 people and service a diverse and broad customer base.

Notice To Reader: Forward Looking Statements This press release contains forward-looking information and forward-looking statements within the meaning of applicable securities laws. We use words such as “anticipate”, “may”, “will”, “should”, “expect”, “believe”, “estimate” and similar expressions to identify forward-looking information and statements especially with respect to growth, outlook and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions, liquidity and operating efficiencies are forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements throughout this document and are also cautioned that the foregoing list of important factors is not exhaustive. These forward-looking statements are based on our plans, intentions or expectations which are based on, among other things, the current improving global economic recovery from the COVID-19 pandemic and containment of any future or similar outbreak of epidemic, pandemic, or contagious diseases that may emerge in the human population, which may have a material effect on how we and our customers operate our businesses and the duration and extent to which this will impact our future operating results, assumptions about the number of automobiles produced in North America and Europe, production mix between passenger cars and trucks, the number of extrusion dies required in North America and South America, the rate of economic growth in North America, Europe and emerging market countries, investment by OEMs in drivetrain architecture and other initiatives intended to reduce fuel consumption and/or the weight of automobiles in response to rising climate risks, raw material prices, supply disruptions, economic conditions, inflation, currency fluctuations, trade restrictions, our ability to integrate acquisitions, our ability to continue increasing market share, or launch of new programs and the rate at which our current and future greenfield operations in Mexico and Morocco achieve sustained profitability. These forward-looking statements include known and unknown risks, uncertainties, assumptions and other factors which may cause actual results or achievements to be materially different from those expressed or implied. The Company will update its disclosure upon publication of each fiscal quarter’s financial results and otherwise disclaims any obligations to update publicly or otherwise revise any such factors or any of the forward-looking information or statements contained herein to reflect subsequent information, events or developments, changes in risk factors or otherwise. For a more extensive discussion of Exco’s risks and uncertainties see the ‘Risks and Uncertainties’ section in our latest Annual Report, Annual Information Form (“AIF”) and other reports and securities filings made by the Company. This information is available at www.sedar.com or www.excocorp.com.

TORONTO, July 06, 2021 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX – XTC) today announced that it will report its financial results for the third quarter ended June 30, 2021 after the close of business on Wednesday July 28, 2021.

Exco’s management will hold a conference call to discuss the results on Thursday July 29, 2021 at 10:00 a.m. To access the live audio webcast, please log on to www.excocorp.com, or https://edge.media-server.com/mmc/p/zmtr7qkc a few minutes before the event. The conference call can also be accessed by dialling toll free at (866) 572-8261 or internationally at (703) 736-7448. The conference ID is 8450289.

For those unable to participate on July 29, 2021, an archived version will be available until August 13, 2021 on the Exco website or by dialling toll free at (855) 859-2056 or internationally at (404) 537-3406. The conference ID is 8450289.

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ approximately 4,800 people and service a diverse and broad customer base.

| Source: | Exco Technologies Limited (TSX-XTC) |

| Contact: | Darren Kirk, President & Chief Executive Officer |

| Telephone: | (905) 477-3065, Ext 7233 |

| Website: | https://www.excocorp.com |

TORONTO, April 28, 2021 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX-XTC) today announced results for its second quarter of fiscal 2021 ended March 31, 2021. In addition, Exco announced a quarterly dividend of $0.10 per common share which will be paid on June 30, 2021 to shareholders of record on June 16, 2021. The dividend is an “eligible dividend” in accordance with the Income Tax Act of Canada.

“Exco’s second quarter results were very strong by almost any measure. Encouragingly we see many opportunities for further gains ahead”, said Darren Kirk, Exco’s President and CEO. “Of course a big thank you goes out to all of our employees for their commitment to working safely through these challenging times.”

Consolidated sales for the second quarter ended March 31, 2021 were $118.4 million compared to $120.2 million in the same quarter last year – a decrease of $1.8 million, or 1%. Excluding foreign exchange rate fluctuations sales increased 4% during the quarter.

The Automotive Solutions segment reported sales of $69.3 million in the second quarter – a decrease of $4.1 million, or 6% from the prior year quarter. Excluding foreign exchange rate movements on Exco’s results, segment revenues were lower by $0.6 million, or 1% during the quarter. After adjusting for the impact of foreign exchange rate movements, the segment continues to perform above IHS vehicle production estimates of negative 5% in North America and negative 1% in Europe in the quarter representing content per vehicle growth. This segment’s sales were favourable when considering the negative impact from the global microchip shortage, continued COVID-19 lockdowns, the Texas snowstorm, and shipping delays from congested ports which reduced vehicle production in the quarter. Segment sales were supported by a number of program launches for both new and existing products and favourable vehicle mix. The segment has received multiple contract wins during the quarter and management continues to see decent quoting activities for new programs across the segment’s various businesses supporting future growth.

The Casting and Extrusion segment reported sales of $49.1 million for the second quarter – an increase of $2.3 million, or 5%, from the same period last year. Excluding the negative impact of foreign exchange movements, the segment’s sales were up 11% and continue to rebound and exceed pre-COVID-19 levels. Segment sales continued the quarterly progression from the low in Q4 F2020 especially in the Extrusion and Castool groups. Extrusion group sales were higher during the quarter as sales at all 6 locations were strong, reflecting high demand for extrusion tools across North and South America across all industry segments. At Castool, the group’s revenues were also higher for the quarter and year-to-date. Demand for Die-Cast consumable tooling has been the primary driver of Castool’s strong sales, but orders for larger capital goods in extrusion end markets increased through the second quarter. The Large Mould group sales were down in the quarter as customers delayed shipping dates on existing programs, however inventories increased in the quarter and new business from current and new customers continues to outpace shipments for this group.

Consolidated net income for the second quarter was $11.7 million or basic and diluted earnings of $0.30 per share compared to $9.5 million or $0.24 per share in the same quarter last year – an increase in net income of 23%. Year-to-date, consolidated net income was $22.7 million or $0.58 per basic share compared to $17.6 million or $0.44 per basic share last year – an increase in net income of 29%. The consolidated effective income tax rate of 22% in the current quarter was the same as the prior year period and the first quarter F2021.

The Automotive Solutions segment reported pre-tax profit of $9.4 million in the second quarter – consistent with the same quarter last year. For the quarter, the segment maintained traditional profitability despite the slight sales decline through continued cost discipline. In addition, new product launches and a favourable sales mix were offset by ramp-up costs for future programs, supply chain challenges, raw material cost inflation, and fluctuations with customer releases caused by uncertainty due to the microchip shortage. Management remains focused on improving the efficiency of its operations and reducing its overall cost structure. Pricing discipline also remains a focus and new program awards include management’s expectations for higher future costs.

The Casting and Extrusion segment reported $7.4 million of pre-tax profit in the second quarter – and increase of $2.9 million or 65% from the prior year quarter. The segment’s profitability improvement was driven by strong efficiency gains in both material and labour usage coupled with greater overhead absorption. This, in turn, reflects our past and ongoing investments in new equipment and processes as part of our various continuous improvement initiatives. Of note, the profitability improvement occurred despite rising input cost inflation, supply chain bottlenecks and current restrictions on travel, which greatly impede management’s ability to operate its various global manufacturing facilities at optimal levels of efficiency.

Consolidated EBITDA for the second quarter totaled $20.2 million compared to $17.6 million in the same quarter last year – an increase of $2.6 million, or 15%. Year-to-date, consolidated EBITDA totaled $39.6 million compared to $33.0 million last year – an increase of $6.6 million, or 20%. For the quarter, EBITDA as a percentage of sales increased to 17.1% compared to 14.7% the prior year driven by an improvement in segment margins in both the Casting & Extrusion segment (22% compared to 17%) and the Automotive Solutions segment (16% compared to 15%).

Operating cash flow before net change in non-cash working capital totaled $17.3 million in the second quarter. After changes in working capital requirements, net cash provided by operating activities amounted to $11.9 million. This cash flow, together with cash on hand was more than sufficient to fund $0.1 million of interest expense, $5.1 million of capital expenditures, and $3.9 million of common dividend payments.

As at March 31, 2021, Exco’s consolidated balance sheet had net cash of $28.4 million. Principal sources of liquidity include generated Free Cash Flow, $37.9 million of balance sheet cash and $40.5 million of unused availability under its $50 million committed credit facility, which matures February 2023. Pursuant to the terms of the credit facility, Exco is required to maintain compliance with certain financial covenants, which the Company was in compliance with as at March 31, 2021.

For further information and prior year comparison please refer to the Company’s Second Quarter Financial Statements in the Investor Relations section posted at www.excocorp.com. Alternatively, please refer to www.sedar.com.

Non-IFRS Measures: In this News Release, reference may be made to EBITDA, EBITDA Margin, Pre-tax Profit and Free Cash Flow which are not measures of financial performance under International Financial Reporting Standards (“IFRS”). Exco calculates EBITDA as earnings before interest, taxes, depreciation, amortization and other expenses and EBITDA Margin as EBITDA divided by sales. Exco calculates Pre-tax Profit as segmented earnings before other income/expense, interest and taxes. Free Cash Flow is calculated as cash provided by operating activities less interest paid less investment in fixed assets net of proceeds of disposal. EBITDA, EBITDA Margin, Pre-tax Profit and Free Cash Flow are used by management, from time to time, to facilitate period-to-period operating comparisons and we believe some investors and analysts use these measures as well when evaluating Exco’s financial performance. These measures, as calculated by Exco, do not have any standardized meaning prescribed by IFRS and are not necessarily comparable to similar measures presented by other issuers.

Quarterly Conference Call – April 29, 2021 at 10:00 a.m. (Toronto time):

To access the live audio webcast, please log on to www.excocorp.com, or https://edge.media-server.com/mmc/p/hkbh522a a few minutes before the event. The conference call can also be accessed by dialling toll free at (866) 572-8261 or internationally at (703) 736-7448. The conference ID is 7124339.

For those unable to participate on April 29 2021, an archived version will be available on the Exco website.

About Exco Technologies Limited:

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ approximately 4,800 people and service a diverse and broad customer base.

Notice To Reader: Forward Looking Statements

Information in this document relating to projected growth and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions and operating efficiencies are forward-looking statements. This press release may contain forward-looking information and forward-looking statements within the meaning of applicable securities laws. We use words such as “anticipate”, “plan”, “may”, “will”, “should”, “expect”, “believe”, “estimate” and similar expressions to identify forward-looking information and statements especially with respect to growth and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions, liquidity and operating efficiencies are forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements throughout this document and are also cautioned that the foregoing list of important factors is not exhaustive. These forward-looking statements are based on our plans, intentions or expectations which are based on, among other things, the current uncertain global economic impact of the COVID-19 pandemic or similar outbreak of epidemic, pandemic, or contagious diseases that may emerge in the human population, which may have a material effect on how we and our customers operate our businesses and the duration and extent to which this will impact our future operating results, assumptions about the number of automobiles produced in North America and Europe, production mix between passenger cars and trucks, the number of extrusion dies required in North America and South America, the rate of economic growth in North America, Europe and emerging market countries, investment by OEMs in drivetrain architecture and other initiatives intended to reduce fuel consumption and/or the weight of automobiles in response to rising climate risks, raw material prices, economic conditions, currency fluctuations, trade restrictions, our ability to close or otherwise dispose of unprofitable operations in a timely manner, our ability to integrate acquisitions and the rate at which our operations in Brazil, and Mexico achieve sustained profitability. These forward-looking statements include known and unknown risks,

uncertainties, assumptions and other factors which may cause actual results or achievements to be materially different from those expressed or

implied. The Company will update its disclosure upon publication of each fiscal quarter’s financial results and otherwise disclaims any obligations to update publicly or otherwise revise any such factors or any of the forward-looking information or statements contained herein to reflect subsequent information, events or developments, changes in risk factors or otherwise. For a more extensive discussion of Exco’s risks and uncertainties see the ‘Risks and Uncertainties’ section in our latest Annual Report, Annual Information Form (“AIF”) and other reports and securities filings made by the Company. This information is available at www.sedar.com or www.excocorp.com.

Interim Report to the Shareholders

For the Six Months Ended March 31, 2021

TORONTO, April 06, 2021 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX – XTC) today announced that it will report its financial results for the second quarter ended March 31, 2021 after the close of business on Wednesday April 28, 2021.

Exco’s management will hold a conference call to discuss the results on Thursday April 29, 2021 at 10:00 a.m. To access the live audio webcast, please log on to www.excocorp.com, or https://edge.media-server.com/mmc/p/hkbh522a a few minutes before the event. The conference call can also be accessed by dialling toll free at (866) 572-8261 or internationally at (703) 736-7448. The conference ID is 7124339.

For those unable to participate on April 29, 2021, an archived version will be available until May 13, 2021 on the Exco website or by dialling toll free at (855) 859-2056 or internationally at (404) 537-3406. The conference ID is 7124339.

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ approximately 4,800 people and service a diverse and broad customer base.

| Source: | Exco Technologies Limited (TSX-XTC) |

| Contact: | Darren Kirk, President & Chief Executive Officer |

| Telephone: | (905) 477-3065, Ext 7233 |

| Website: | https://www.excocorp.com |

TORONTO, Feb. 05, 2021 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX: XTC) (“Exco” or the “Company”) today announced that the Toronto Stock Exchange (“TSX”) has approved the Company’s normal course issuer bid (“NCIB”). Under the NCIB, Exco has the right to purchase for cancellation, from February 18, 2021 to February 17, 2022, a maximum of 1,960,000 common shares, representing 9.5% of the 20,575,656 shares forming Exco’s public float as at February 3, 2021. As of February 5, 2021, Exco had 39,268,997 common shares issued and outstanding.

Any shares purchased by Exco under the NCIB will be effected through the facilities of TSX as well as on alternative Canadian trading systems, at prevailing market rates and any common shares purchased by the Company will be cancelled. The actual number of shares that may be purchased and the timing of any such purchases will be determined by Exco. Any purchases made by Exco pursuant to the NCIB will be made in accordance with the rules and policies of the TSX.

During the most recently-completed six months, the average daily trading volume for the common shares of Exco on the TSX was 37,714 shares. Consequently, under the policies of the TSX, Exco will have the right to repurchase under its NCIB, during any one trading day, a maximum of 9,428 shares, representing 25% of the average daily trading volume. In addition, Exco will be allowed to make, once per calendar week, a block purchase (as such term is defined in the TSX Company Manual) of shares not directly or indirectly owned by insiders of Exco, in accordance with the TSX policies. Exco will fund the purchases through available cash and/or bank facilities. Pursuant to a previous notice of intention to conduct a normal course issuer bid, under which Company sought and received approval from the TSX to purchase up to 2,000,000 common shares for the period of February 18, 2020 to February 17, 2021, the Company has purchased 625,366 common shares on the open market as of February 5, 2021 at a weighted average purchase price of $6.78 per common share.

Exco’s Board of Directors believes the underlying value of the Company may not be reflected in the market price of its common shares from time to time and that, at appropriate times, repurchasing its shares through the NCIB may represent a good use of Exco’s financial resources, as such action can protect and enhance shareholder value when opportunities or volatility arise. Thus, the Board has determined that the NCIB is in the best interest of the Company and its shareholders.

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ about 4,800 people and service a diverse and broad customer base.

Source: Exco Technologies Limited (TSX-XTC)

Contact: Darren Kirk, President and Chief Executive Officer

Telephone: (905) 477-3065 ext. 7233

Website: https://www.excocorp.com

TORONTO, Feb. 03, 2021 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX-XTC) announced voting results from its 2020 annual meeting of shareholders held on February 2, 2021. A total of 25,898,338 Common Shares or 65.95% of our issued and outstanding Common Shares, were voted in connection with the meeting. Based on proxies received prior to the meeting, each director nominee was elected by a substantial majority as follows:

| Votes For | Votes Withheld/Against | |

| Edward H. Kernaghan | 94.3% | 5.7% |

| Darren M. Kirk | 99.6% | 0.4% |

| Robert B. Magee | 99.7% | 0.3% |

| Colleen M. McMorrow | 99.6% | 0.4% |

| Paul E. Riganelli | 86.4% | 13.6% |

| Brian A. Robbins | 95.1% | 4.9% |

| Anne Marie Turnbull | 99.7% | 0.3% |

Appendix A

VOTING RESULTS – 2020 ANNUAL MEETING OF SHAREHOLDERS

| Votes For | Votes Withheld/ Against | |||

| Resolution | # | % | # | % |

| Elect Edward H. Kernaghan as Director | 24,259,472 | 94.3% | 1,476,854 | 5.7% |

| Elect Darren M. Kirk as Director | 25,634,418 | 99.6% | 101,908 | 0.4% |

| Elect Robert B. Magee as Director | 25,662,302 | 99.7% | 74,024 | 0.3% |

| Elect Colleen M. McMorrow as Director | 25,643,474 | 99.6% | 92,852 | 0.4% |

| Elect Paul E. Riganelli as Director | 22,231,147 | 86.4% | 3,505,179 | 13.6% |

| Elect Brian A. Robbins as Director | 24,465,389 | 95.1% | 1,270,937 | 4.9% |

| Elect Anne Marie Turnbull as Director | 25,668,461 | 99.7% | 67,865 | 0.3% |

| Appointment of Ernst & Young, LLP as Auditors | 25,810,217 | 99.7% | 88,121 | 0.3% |

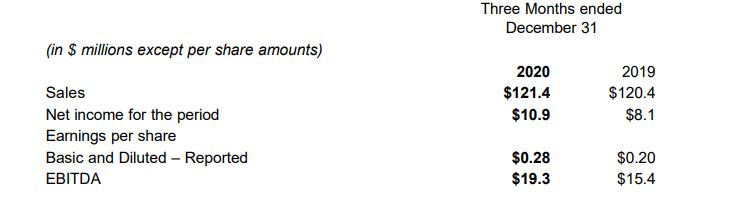

• Consolidated Sales of $121.4 million

• EBITDA of $19.3 million compared to $15.4 million prior year

• EBITDA margin of 15.9% compared to 12.8% prior year

• EPS of $0.28 compared to $0.20 prior year

• Quarterly dividend raised 5% to $0.10 per common share

• Financial position and liquidity remain strong with $26.5 million net cash

TORONTO, Feb. 02, 2021 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX-XTC) today announced results for its first quarter of fiscal 2021 ended December 31, 2020. In addition, Exco announced a 5% increase in its quarterly dividend to $0.10 per common share which will be paid on March 31, 2021 to shareholders of record on March 17, 2021. The dividend is an “eligible dividend” in accordance with the Income Tax Act of Canada.

“Exco achieved very strong results in our first quarter of fiscal 2021”, said Darren Kirk. “We are optimistic this performance will continue, supporting our Board’s decision to increase our dividend for the 12th consecutive year”, added Kirk.

Consolidated sales for the first quarter ended December 31, 2020 were $121.4 million compared to $120.4 million in the same quarter last year – an increase of $1.0 million or less than 1%. The impact of a strengthening Canadian dollar compared to the USD and Euro was essentially flat.

The Automotive Solutions segment reported sales of $76.1 million in the first quarter – an increase of $7.8 million, or 11% from the same quarter last year. Foreign exchange rate movements increased sales in this segment by $0.6 million. The segment’s sales increase compares favorably to overall industry vehicle production volumes in North America and Europe which were relatively flat in the quarter. Segment sales were supported by a number of program launches for both new and existing products, higher order volumes as OEMs continue to fill the pipeline and adjust safety stock levels due to the impact of COVID -19, favourable product mix and higher tooling sales. The segment has received multiple contract wins during the quarter and management continues to see strong quoting activities for new potential programs across the segment’s various business

supporting future growth.

The Casting and Extrusion segment reported sales of $45.3 million in the quarter – a decrease of $6.8 million, or 13%, from the same period last year. Excluding modest foreign exchange rate movements, segment sales were lower due to the deterioration of economic conditions due to COVID-19 compared to the first quarter 2020, changes in product mix and delivery timing as well as lower steel costs. Sales at Extrusion and Castool were marginally lower than the prior year quarter and the Large Mould group continues to build new tools and win contracts, however, shipments were lower compared to the prior year quarter. First quarter 2021 sales were down compared to the first quarter 2020, however, sequentially sales are up $5.8 million or 15% compared to the fourth quarter 2020. This 15% quarter over quarter increase reflects increased demand across the Large Mould, Extrusion and the Castool groups. This segment continued to receive considerable quotation requests and order input remains strong particularly within the die-cast end markets where the Large Mould and Castool groups are winning new orders from existing and new customers.

Consolidated net income for the first quarter was $10.9 million or basic and diluted earnings of $0.28 per share compared to $8.1 million or $0.20 per share in the same quarter last year – an increase in net income of 35%. The consolidated effective income tax rate for the current quarter was 22% compared to 18% the prior year period. The income tax rate in the prior year quarter was favorably impacted by the recognition of deferred tax assets and an increase in earnings in jurisdictions with lower tax rates. Excluding the recognition of the deferred tax assets, the effective income tax rate for the prior year quarter was 20%.

The Automotive Solutions segment reported pre-tax profit of $11.6 million in the quarter – an increase of $3.6 million or 45% over the same quarter last year. The key factors in this segment’s improved margins include improved cost absorption with higher sales, lower costs due to management’s actions associated with the pandemic which improved operational efficiencies, and favourable product mix. In addition, the prior year quarter segment pre-tax profits were negatively impacted by adverse foreign exchange rate movements, the impact of the strike at General Motors and certain program launch costs inefficiencies.

Management remains focused on improving the efficiency of its operations and reducing its overall cost structure. Pricing discipline also remains a focus and new program awards embed management’s expectations for higher future costs.

The Casting and Extrusion segment reported $4.6 million of pretax profit in the quarter – an increase of $0.3 million or 7% from the same quarter last year. The Extrusion group’s profits benefited from a balanced sales performance across all locations and lower steel costs. The Castool group benefited from lower selling costs and a shift to higher margin products. Although quoting activity and new business awards were strong in the quarter in the Large Mould Group, actual shipments of tools were dampened due to the impact of COVID-19 in the prior quarters.

Additionally, Large Mould costs were impacted by new work on several new programs. Margins tend to be lower at the front end and improve as incremental moulds are completed. As the backlog continues to increase, these timing issues are expected to reverse in the following quarters. The Corporate segment expenses were $2.2 million in the quarter compared to $2.4 million in the prior year quarter.

Consolidated EBITDA for the first quarter totaled $19.3 million compared to $15.4 million in the same quarter last year – an increase of 25%. EBITDA as a percentage of sales increased to 15.9% in the current quarter compared to 12.8% the prior year. The EBITDA margin in the Casting and Extrusion segment increased to 18.0% from 14.8% last year while the EBITDA margin in the Automotive Solutions segment increased to 17.5% compared to 14.5% last year.

Operating cash flow before net change in non-cash working capital totaled $16.4 million in the first quarter. After changes in working capital requirements, net cash provided by operating activities amounted to $9.6 million. This cash flow, together with cash on hand was used to fund $0.1 million of interest expense, $5.1 million of capital expenditures and $3.7 million of common dividend payments. As at December 31, 2020, Exco’s consolidated balance sheet was in a $26.5 million net cash position.

For further information and prior year comparison please refer to the Company’s First Quarter Financial Statements in the Investor Relations section posted at www.excocorp.com. Alternatively, please refer to www.sedar.com.

1 Non-IFRS Measures: In this News Release, reference may be made to EBITDA, EBITDA Margin, Pretax Profit and Free Cash Flow which are not measures of financial performance under International Financial Reporting Standards (“IFRS”). Exco calculates EBITDA as earnings before interest, taxes, depreciation, amortization and other expenses and EBITDA Margin as EBITDA divided by sales. Exco calculates Pretax Profit as segmented earnings before other income/expense, interest and taxes. Free Cash Flow is calculated as cash provided by operating activities less interest paid less investment in fixed assets net of proceeds of disposal. EBITDA, EBITDA Margin, Pretax Profit and Free Cash Flow are used by management, from time to time, to facilitate period-to-period operating comparisons and we believe some investors and analysts use these measures as well when evaluating Exco’s financial performance. These measures, as calculated by Exco, do not have any standardized meaning prescribed by IFRS and are not necessarily comparable to similar measures presented by other issuers.

Quarterly Conference Call – February 3, 2021 at 10:00am. (Toronto time):

To access the live audio webcast, please log on to www.excocorp.com, or https://edge.media-server.com/mmc/p/edwdo9co a few minutes before the event. The conference call can be accessed by dialing toll free at (866) 572-8261 or internationally at (703) 736-7448. The conference ID is 4574609.

For those unable to participate on February 3, 2021, an archived version will be available on the Exco website.

Source: Exco Technologies Limited (TSX-XTC)

Contact: Darren Kirk, President and CEO

Telephone: (905) 477-3065 Ext. 7233

Website: https://www.excocorp.com

About Exco Technologies Limited:

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ about 4,800 people and service a diverse and broad customer base.

Notice To Reader: Forward Looking Statements

Information in this document relating to projected growth and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions and operating efficiencies are forward-looking statements. This press release may contain forward-looking information and forward-looking statements within the meaning of applicable securities laws. We use words such as “anticipate”, “plan”, “may”, “will”, “should”, “expect”, “believe”, “estimate” and similar

expressions to identify forward-looking information and statements especially with respect to growth and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions, liquidity and operating efficiencies are forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements throughout this document and are also cautioned that the foregoing list of important factors is not exhaustive. These forward-looking statements are based our plans, intentions or expectations which are based on, among other things, the current uncertain global economic impact of the COVID-19 pandemic or similar outbreak of epidemic, pandemic, or contagious diseases that may emerge in the human population, which may have a material effect on how we and our customers operate our businesses and the duration and extent to which this will impact our future operating results, assumptions about the number of automobiles produced in North America and Europe, production mix between passenger cars and trucks, the number of extrusion dies required in North America and South America, the rate of economic growth in North America, Europe and emerging market countries, investment by OEMs in drivetrain architecture and other initiatives intended to reduce fuel consumption and/or the weight of automobiles in response to rising climate risks, raw material prices, economic conditions, currency fluctuations, trade restrictions, our ability to close or otherwise dispose of unprofitable operations in a timely manner, our ability to integrate acquisitions and the rate at which our operations in Brazil, and Mexico achieve sustained profitability. These forward-looking statements include known and unknown risks, uncertainties, assumptions and other factors which may cause actual results or achievements to be materially different from those expressed or implied. The Company will update its disclosure upon publication of each fiscal quarter’s financial results and otherwise disclaims any obligations to update publicly or otherwise revise any such factors or any of the forward-looking information or statements contained herein to reflect subsequent information, events or developments, changes in risk factors or otherwise. For a more extensive discussion of Exco’s risks and uncertainties see the ‘Risks and Uncertainties’ section in our latest Annual Report, Annual Information Form (“AIF”) and other reports and securities filings made by the Company. This information is available at www.sedar.com or www.excocorp.com

TORONTO, Feb. 02, 2021 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX-XTC) today announced a quarterly cash dividend of $0.10 per common share to be paid on March 31, 2021 to shareholders of record on March 17, 2021. This dividend represents a 5.3% increase from previous levels. The dividend is an “eligible dividend” in accordance with the Income Tax Act of Canada.

Darren Kirk, Exco’s President and CEO, “I am pleased to announce this dividend increase, which reflects our confidence in Exco’s ability to continue generating significant free cash flow in the years ahead”. The annualized dividend represents 36% of Exco’s trailing twelve-month free cash flow. This is the thirteenth time Exco has increased its dividend in twelve consecutive years.

Source: Exco Technologies Limited (TSX-XTC)

Contact: Darren Kirk, Executive President and Chief Executive Officer

Telephone: (905) 477-3065 Ext. 7233

Website: https://www.excocorp.com

About Exco Technologies Limited:

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ about 4,800 people and service a diverse and broad customer base.

Notice To Reader: Forward Looking Statements

Information in this document relating to projected growth and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions and operating efficiencies are forward-looking statements.

This press release may contain forward-looking information and forward-looking statements within the meaning of applicable securities laws. We use words such as “anticipate”, “plan”, “may”, “will”, “should”, “expect”, “believe”, “estimate” and similar expressions to identify forward-looking information and statements especially with respect to growth and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions, liquidity and operating efficiencies are forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements throughout this document and are also cautioned that the foregoing list of important factors is not exhaustive. These forward-looking statements are based on our plans, intentions or expectations which are based on, among other things, the current uncertain global economic impact of the COVID-19 pandemic or similar outbreak of epidemic, pandemic, or contagious diseases that may emerge in the human population, which may have a material effect on how we and our customers operate our businesses and the duration and extent to which this will impact our future operating results, assumptions about the number of automobiles produced in North America and Europe, production mix between passenger cars and trucks, the number of extrusion dies required in North America and South America, the rate of economic growth in North America, Europe and emerging market countries, investment by OEMs in drivetrain architecture and other initiatives intended to reduce fuel consumption and/or the weight of automobiles in response to rising climate risks, raw material prices, economic conditions, currency fluctuations, trade restrictions, our ability to close or otherwise dispose of unprofitable operations in a timely manner, our ability to integrate acquisitions and the rate at which our operations in Brazil, and Mexico achieve sustained profitability. These forward-looking statements include known and unknown risks, uncertainties, assumptions and other factors which may cause actual results or achievements to be materially different from those expressed or implied. The Company will update its disclosure upon publication of each fiscal quarter’s financial results and otherwise disclaims any obligations to update publicly or otherwise revise any such factors or any of the forward-looking information or statements contained herein to reflect subsequent information, events or developments, changes in risk factors or otherwise. For a more extensive discussion of Exco’s risks and uncertainties see the ‘Risks and Uncertainties’ section in our latest Annual Report, Annual Information Form (“AIF”) and other reports and securities filings made by the Company. This information is available at www.sedar.com or www.excocorp.com.