Unaudited Condensed Interim Report to the shareholders

for the nine months ended June 30, 2020

3rd Quarter 2020

Unaudited Condensed Interim Report to the shareholders

for the nine months ended June 30, 2020

TORONTO, July 29, 2020 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX-XTC) today announced results for its third quarter of fiscal 2020 ended June 30, 2020. In addition, Exco announced a quarterly dividend of $0.095 per common share which will be paid on September 30, 2020 to shareholders of record on September 16, 2020. The dividend is an “eligible dividend” in accordance with the Income Tax Act of Canada.

“Exco’s diversity of operations, strong market positions of our various businesses and commitment from our dedicated employees to work safely enabled us to outperform the industry through very difficult conditions this quarter”, said Darren Kirk, Exco’s President and CEO. “We continued to generate very strong free cash flow and have furthered bolstered our net cash position, which positions us well for the recovery”, added Kirk.

In response to the global COVID-19 pandemic, Exco continues to take the necessary actions to protect the health and safety of our employees, meet the ongoing needs of our customers, minimize the adverse impact on our finances, while making the necessary investments to further strengthen our various businesses for the recovery as it takes hold.

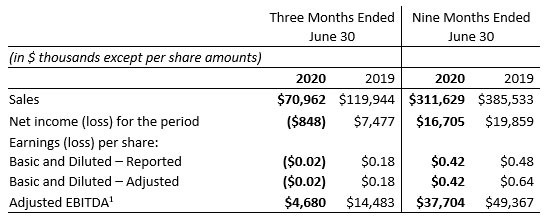

Consolidated sales for the third quarter ended June 30, 2020 were $71.0 million compared to $119.9 million in the same quarter last year – a decrease of $49.0 million, or 41%. Year-to-date sales were $311.6 million compared to $385.5 million the prior year – a decrease of $73.9 million or 19%.

The Automotive Solutions segment reported sales of $28.2 million in the third quarter – a decrease of $42.9 million, or 60% compared to last year. Reductions in sales during the quarter were primarily driven by the virtual standstill of automotive production levels in Exco’s key markets as a result of COVID-19 response measures through much of April and May 2020. Economic activity picked up as the quarter progressed, with June segment sales showing a marked improvement over May, although at a level still well below the prior year. Year-to-date results were additionally affected by $19.8 million of revenues generated by ALC in the first quarter of fiscal 2019 before that entity was deconsolidated from Exco’s results. Excluding foreign exchange rate movements and the impact of ALC on Exco’s results in Q1 F19, segment revenues were lower by $43.6 million, or 61% during the quarter and $44.8 million, or 21% year-to-date. This compares favorably to combined overall industry vehicle production volumes in North America and Europe, which were lower by roughly 68% during the quarter and 30% year-to-date. The segment’s outperformance compared to the industry during the quarter was primarily attributable to the sale of accessory product sales to OEM’s in North America, which are more closely aligned to vehicle sales levels than production volumes. To that end, US light vehicle sales levels held up significantly better than overall production levels during the quarter, falling by approximately 33% year over year. Segment sales outperformance compared to the industry in both the quarter and year-to-date periods were also helped by a number of program launches for both new and existing products that commenced earlier in the fiscal year. Looking forward, combined OEM production levels in Europe and North America are expected to normalize at around 90% of prior year levels through the remaining two calendar quarters of 2020. However there remains significant uncertainty around these expectations due to the unknown impact of COVID-19. In the interim, Exco remains focused on its product development, sales and marketing efforts to gain market share, and ensuring it is able meet future demand, while complying with any stay-at-home orders in the regions where it operates.

The Casting and Extrusion segment reported sales of $42.8 million for the third quarter – a decrease of $6.1 million, or 13%, from the same period last year. Segment sales held up better during the quarter than general economic conditions would otherwise suggest given the long cycle and/or essential nature of much of the segment’s products, which feed into many critical industries. Within the group, sales were higher in the Large Mould group for the quarter. The programs of this group tend to be relatively long cycle and continued to advance despite the vehicle production stoppage at all OEM’s ultimately served by the group through much of April and May 2020. In addition, quoting activity remains decent with discussions ongoing with both current and new potential customers, holding promise for future demand. Extrusion group sales were lower during the quarter due to much softer overall market conditions, including in the building and construction sector, which is the largest driver of demand for extrusion tooling. Exco however believes it outperformed the industry, helped by the benefits of our multi-plant footprint and harmonized manufacturing methods at our various locations. Year-to-date group sales were affected by modestly softer industry conditions that existed prior to the emergence of COVID-19 but tempered by sales from our new Extrusion facility in Mexico, which commenced commercial production April 1, 2019. At Castool, the group’s revenues were lower as market conditions softened for both consumable and capital equipment goods in the quarter. This was evident in both the extrusion – and particularly die-cast – end markets. However, with the start-up of automotive OEM production in the months of May and June, trends within the group improved in the latter half of the quarter. Also within the segment, steel price surcharges and steel tariffs continued to reduce during the quarter. As Exco generally aims to pass such amounts on to its customers, they positively impact on revenues when higher, but have the opposite impact when lower.

Consolidated net loss for the third quarter was $0.8 million or basic and diluted loss of $0.02 per share compared to an income of $7.5 million or $0.18 earnings per share in the same quarter last year. Year-to-date, consolidated net income was $16.7 million or $0.42 per basic share compared to $19.9 million or $0.48 per basic share last year – a decrease in net income of 16%. Excluding a net expense of $6.4 million in the prior year-to-date period related to the deconsolidation of ALC, Adjusted Net Income was lower by 36%. The consolidated effective income tax rate for the current quarter was 10% compared to 20% the prior year period with the difference primarily attributable to the impact of operating losses in certain jurisdictions partially offset by gains elsewhere. Year-to-date, the consolidated effective income tax rate was 21% compared to 29% last year. The income tax rate in the prior year-to-date period was unfavorably impacted by the non-deductibility of Other Expense related to the writedown of ALC in the amount of $6.4 million and $2.1 million of operating losses at ALC. Excluding these items, the effective income tax rate for the prior year-to-date period was 22%.

The Automotive Solutions segment reported pretax losses of $3.8 million in the third quarter compared to pretax profits of $7.9 million in the same quarter last year. Year-to-date, the segment reported pretax profit of $13.7 million – a decrease of $13.2 million or 49% compared to the prior year period. For the quarter, segment profitability was negatively impacted by lost absorption of overheads and other fixed costs arising from sharply lower sales together with the continuance of labor costs for certain production workers in Mexico where there is limited ability to temporarily lay-off employees onto government support programs. Management took significant action during the quarter to minimize the negative impact on its results, including implementing work share arrangements, restraining expenses, temporarily laying off workers where possible and availing itself of certain government support programs. In addition to the above, year-to-date results were hampered by the impact of the strike at General Motors, unfavorable product mix shifts in the first quarter of fiscal 2020 and an increase in accounts receivable and other provisions in the second quarter of fiscal 2020. Year-to-date profitability however benefited from reduced bonus payments to production workers in Mexico as well as the elimination of ALC’s operations, which contributed operating losses of $2.1 million in the first quarter of fiscal 2019. To counter ongoing pricing pressures and rising input costs, management remains focused on improving the efficiency of its operations and reducing its overall cost structure. Pricing discipline also remains a focus, although there is typically limited, if any, ability to attain increased pricing for the duration of current programs, which typically range from three to five years. Pricing for new programs however embed management’s expectations for higher future costs.

The Casting and Extrusion segment reported $4.9 million of pretax profit in the third quarter – an increase of $1.1 million or 28% from the same quarter last year. Year-to-date, the segment reported pretax profit of $13.8 million – a decrease of $0.2 million, or effectively unchanged compared to the prior year period. Higher profitability during the quarter was supported by continued progress with various efficiency initiatives, a favorable mix shift towards higher margin programs in the Large Mould group, lower steel prices and receipt of R&D credits. As well, Management undertook significant action to minimize the negative impact of lower sales volumes during the quarter, including implementing work-share arrangements, restraining expenditures generally and availing government support programs, where possible.

Operating cash flow before net change in non-cash working capital totaled $5.0 million in the third quarter while lower working capital requirements due to reduced sales levels provided an additional $15.6 million of cash. Consequently, net cash provided by operating activities amounted to $20.6 million in the quarter. This cash flow was more than sufficient to fund $0.2 million of interest expense, $4.3 million of net capital expenditures and $3.8 million of common dividend payments.

As at June 30, 2020, Exco’s consolidated balance sheet was in a $23.7 million net cash position compared to $8.7 million as at September 30, 2019. Principal sources of liquidity include generated Free Cash Flow, $47.4 million of balance sheet cash and $27.0 million of unused availability under its $50 million committed credit facility, which matures February 2023. Subsequent to quarter end, the Company repaid $20 million of its credit facility from its cash on hand. Pursuant to the terms of the credit facility, Exco is required to maintain compliance with certain financial covenants, which the Company was in compliance with as at June 30, 2020.

For further information and prior year comparison please refer to the Company’s Third Quarter Financial Statements in the Investor Relations section posted at www.excocorp.com. Alternatively, please refer to www.sedar.com.

1 Non-IFRS Measures: In this News Release, reference may be made to Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EPS, Adjusted Net Income, Adjusted Pretax Profit and Free Cash Flow which are not measures of financial performance under International Financial Reporting Standards (“IFRS”). Exco calculates Adjusted EBITDA as earnings before other income/expense, interest, taxes, depreciation and amortization and Adjusted EBITDA Margin as Adjusted EBITDA divided by sales. Exco calculates adjusted EPS as earnings before other income/expense divided by the weighted average number of shares. Adjusted Net Income is calculated as net income before other income/expense, and Adjusted Pretax Profit as segmented earnings before other income/expense, interest and taxes. Free Cash Flow is calculated as cash provided by operating activities less interest paid less investment in fixed assets net of proceeds of disposal. Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EPS, pretax profit and Free Cash Flow are used by management, from time to time, to facilitate period-to-period operating comparisons and we believe some investors and analysts use these measures as well when evaluating Exco’s financial performance. These measures, as calculated by Exco, do not have any standardized meaning prescribed by IFRS and are not necessarily comparable to similar measures presented by other issuers. Refer to the table in the Management Discussion and Analysis for a reconciliation of these non-IFRS Measures.

Quarterly Conference Call – July 30, 2020 at 10:00 a.m. (Toronto time):

To access the live audio webcast, please log on to www.excocorp.com, or https://edge.media-server.com/mmc/p/e3s8amz8 a few minutes before the event. The conference call can be accessed by dialing toll free at (855) 859-2056 or internationally at (703) 736-7448. The conference ID is 9182891.

For those unable to participate on July 30, 2020, an archived version will be available on the Exco website.

| Source: | Exco Technologies Limited (TSX-XTC) |

| Contact: | Darren Kirk, President & Chief Executive Officer |

| Telephone: | (905) 477-3065, Ext 7233 |

| Website: | https://www.excocorp.com |

About Exco Technologies Limited:

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ about 5,000 people and service a diverse and broad customer base.

Notice To Reader: Forward Looking Statements

Information in this document relating to projected growth and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions and operating efficiencies are forward-looking statements. This press release may contain forward-looking information and forward-looking statements within the meaning of applicable securities laws. We use words such as “anticipate”, “plan”, “may”, “will”, “should”, “expect”, “believe”, “estimate” and similar expressions to identify forward-looking information and statements especially with respect to growth and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions, liquidity and operating efficiencies are forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements throughout this document and are also cautioned that the foregoing list of important factors is not exhaustive. These forward-looking statements are based on our plans, intentions or expectations which are based on, among other things, the current uncertain global economic impact of the COVID-19 pandemic or similar outbreak of epidemic, pandemic, or contagious diseases that may emerge in the human population, which may have a material effect on how we and our customers operate our businesses and the duration and extent to which this will impact our future operating results, assumptions about the number of automobiles produced in North America and Europe, production mix between passenger cars and trucks, the number of extrusion dies required in North America and South America, the rate of economic growth in North America, Europe and emerging market countries, investment by OEMs in drivetrain architecture and other initiatives intended to reduce fuel consumption and/or the weight of automobiles in response to rising climate risks, raw material prices, economic conditions, currency fluctuations, trade restrictions, our ability to close or otherwise dispose of unprofitable operations in a timely manner, our ability to integrate acquisitions and the rate at which our operations in Brazil, and Mexico achieve sustained profitability. These forward-looking statements include known and unknown risks, uncertainties, assumptions and other factors which may cause actual results or achievements to be materially different from those expressed or implied. The Company will update its disclosure upon publication of each fiscal quarter’s financial results and otherwise disclaims any obligations to update publicly or otherwise revise any such factors or any of the forward-looking information or statements contained herein to reflect subsequent information, events or developments, changes in risk factors or otherwise. For a more extensive discussion of Exco’s risks and uncertainties see the ‘Risks and Uncertainties’ section in our latest Annual Report, Annual Information Form (“AIF”) and other reports and securities filings made by the Company. This information is available at www.sedar.com or www.excocorp.com

TORONTO, July 06, 2020 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX – XTC) today announced that it will report its financial results for the third quarter ended June 30, 2020 after the close of business on Wednesday July 29, 2020.

A conference call to discuss those results will be held on Thursday, July 30, 2020 at 10:00 a.m. (Eastern time) which can be accessed by dialling toll free at (866) 572-8261 or internationally at (703) 736-7448. The conference ID is 9182891.

To access the live audio webcast, please log on to www.excocorp.com, or https://edge.media-server.com/mmc/p/e3s8amz8 a few minutes before the event.

For those unable to participate on July 30, 2020, an archived version will be available until August 7, 2020 on the Exco website or by dialling toll free at (855) 859-2056 or internationally at (404) 537-3406. The conference ID is 9182891.

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ approximately 5,400 people and service a diverse and broad customer base.

| Source: | Exco Technologies Limited (TSX-XTC) |

| Contact: | Darren Kirk, President & Chief Executive Officer |

| Telephone: | (905) 477-3065, Ext 7233 |

| Website: | https://www.excocorp.com |

Unaudited Condensed Interim Report to the shareholders

for the six months ended March 31, 2020

Toronto, April 29, 2020 – Exco Technologies Limited (TSX-XTC) today announced results for its second quarter of fiscal 2020 ended March 31, 2020. In addition, Exco announced a quarterly dividend of $0.095 per common share which will be paid on June 30, 2020 to shareholders of record on June 16, 2020. The dividend is an “eligible dividend” in accordance with the Income Tax Act of Canada.

| (in $ thousands except per share amounts) | Three Months Ended March 31 | Six Months Ended March 31 | ||

| 2020 | 2019 | 2020 | 2019 | |

| Sales | $120,244 | $123,465 | $240,667 | $265,589 |

| Net income for the period | $9,495 | $8,564 | $17,553 | $12,382 |

| Earnings per share: Basic and Diluted – Reported | $0.24 | $0.21 | $0.44 | $0.30 |

| Basic and Diluted – Adjusted | $0.24 | $0.22 | $0.44 | $0.45 |

| Adjusted EBITDA1 | $17,642 | $16,304 | $33,024 | $34,884 |

“Exco performed very well despite an extremely difficult backdrop”, said Darren Kirk, Exco’s President and CEO, adding that, “I want to thank all of our employees for working safely, enabling us to meet the continuing needs of our customers throughout these challenging times”.

In response to the unprecedented global COVID-19 crises, Exco is taking the necessary actions to protect the health and safety of our employees, meet the ongoing needs of our customers, minimize the adverse impact on our finances, while making the necessary investments to further strengthen our various businesses for the recovery when it eventually takes hold.

Consolidated sales for the second quarter ended March 31, 2020 were $120.2 million compared to $123.5 million in the same quarter last year – a decrease of $3.3 million, or 3%. Foreign exchange rate fluctuations contributed $2.5 million to sales during the quarter.

The Automotive Solutions segment reported sales of $73.4 million in the second quarter – effectively unchanged from the prior year quarter. Excluding foreign exchange rate movements, segment revenues were lower by $1.5 million, or 2% during the quarter. This compares favorably to combined overall industry vehicle production volumes in North America and Europe, which were lower by roughly 16% during the quarter. Segment sales were supported by a number of program launches for both new and existing products, particularly at Polydesign and AFX. Sales were softer year over year at both Neocon and Polytech, however both these entities outperformed the market due to the strength of their product portfolios and aided – in part – by accessory product sales, which do not always sync with OEM production schedules. Automotive production throughout April 2020 is virtually at a standstill in Exco’s key markets as a result of the global COVID-19 response measures. Looking forward several OEM’s are currently planning to restart production of facilities in Europe and North America beginning in early May 2020, however there remains considerable uncertainly around the exact timing and how fast these facilities will ramp-up volume. Exco remains focused on ensuring it is able to meet demand once production recommences, while complying with stay-at-home orders in the regions where it operates.

The Casting and Extrusion segment reported sales of $46.8 million for the second quarter – a decrease of $3.4 million, or 7%, from the same period last year. Segment sales held up better during the quarter than general economic conditions would otherwise suggest given the long cycle and/or essential nature of much of the segment’s products, which feed into many critical industries. Within the group, sales were relatively stable in the Large Mould group for the quarter. The programs of this group tend to be relatively long cycle and have continued to advance despite the vehicle production stoppage through April 2020 at virtually all OEM’s ultimately served by the group. In addition, quoting activity remains decent with discussions ongoing with both current and new potential customers, holding promise for an improvement in future results. Extrusion group sales were lower during the quarter as sales from the new Extrusion facility in Mexico (which commenced commercial production April 1, 2019) were more than offset by lower sales elsewhere in North America due to softer overall market conditions. At Castool, the group’s revenues were also modestly lower as market conditions softened for both consumable and capital equipment goods in the quarter, particularly within the extrusion industry. Within the segment, steel price surcharges and steel tariffs continued to reduce during the quarter. As Exco generally aims to pass such amounts on to its customers, they positively impact on revenues when higher, but have the opposite impact when lower.

Consolidated net income for the second quarter was $9.5 million or basic and diluted earnings of $0.24 per share compared to $8.6 million or $0.21 per share in the same quarter last year – an increase in net income of 11%. Year-to-date, consolidated net income was $17.6 million or $0.44 per basic share compared to $12.4 million or $0.30 per basic share last year – an increase in net income of 42%. Excluding a net expense of $0.3 million and $6.4 million in the prior year periods related to the deconsolidation of ALC, Adjusted Net Income was higher by 7% in the quarter and lower by 7% year-to-date. The consolidated effective income tax rate for the current quarter was 22% compared to 23% the prior year period. The Automotive Solutions segment reported pretax profit of $9.4 million in the second quarter – an increase of $0.3 million or 3% over the same quarter last year. For the quarter, segment profitability was enhanced by improved overhead absorption at Polydesign and AFX, reduced bonus payments to production workers in Mexico, as well as greater operating efficiencies and favorable foreign exchange rate movements across the segment in general. The benefit of these factors outweighed an increase in accounts receivable and other provisions during the quarter to address likely near-term

stresses associated with the current global downturn. To counter ongoing pricing pressures and rising input costs, management remains focused on improving the efficiency of its operations and reducing its overall cost structure. Pricing discipline also remains a focus, although there is typically limited, if any, ability to attain increased pricing for the duration of current programs, which typically range from three to five years. New programs however embed management’s expectations for higher future costs.

The Casting and Extrusion segment reported $4.5 million of pretax profit in the second quarter – a decrease of $0.1 million or 2% from the same quarter last year. Profitability reduction occurred within the Extrusion group for the quarter due to adverse overhead absorption given the decline in extrusion die volumes. Separately, profitability at the Large Mould group was higher during the quarter as progress with various efficiency initiatives continued to move ahead. Castool’s profitability was up during the quarter despite the sales decline due to a reduction in steel prices and favorable foreign exchange rate movements.

Operating cash flow before net change in non-cash working capital totaled $15.0 million in the second quarter. After changes in working capital requirements, net cash provided by operating activities amounted to $18.6 million. This cash flow, together with cash on hand was more than sufficient to fund $0.2 million of interest expense, $5.9 million of capital expenditures, $3.8 million of common dividend payments and $3.3 million of share repurchases.

As at March 31, 2020, Exco’s consolidated balance sheet was in a $11.9 million net cash position. Principal sources of liquidity include generated Free Cash Flow, $35.7 million of balance sheet cash and $27.0 million of unused availability under its $50 million committed credit facility, which matures February 2023. Pursuant to the terms of the credit facility, Exco is required to maintain compliance with certain financial covenants, which the Company was in compliance with as at March 31, 2020. In response to the developments resulting from the COVID-19 pandemic, the Company has stress tested its financial and liquidity position and expects to remain Free Cash Flow positive through the second half of fiscal 2020 while remaining in compliance with its financial covenants.

For further information and prior year comparison please refer to the Company’s Second Quarter Financial Statements in the Investor Relations section posted at www.excocorp.com. Alternatively, please refer to www.sedar.com.1 Non-IFRS Measures: In this News Release, reference may be made to Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EPS, Adjusted Net Income, Adjusted Pretax Profit and Free Cash Flow which are not measures of financial performance under International Financial Reporting Standards (“IFRS”). Exco calculates Adjusted EBITDA as earnings before other income/expense, interest, taxes, depreciation and amortization and Adjusted EBITDA Margin as Adjusted EBITDA divided by sales. Exco calculates adjusted EPS as earnings before other income/expense divided by the weighted

average number of shares. Adjusted Net Income is calculated as net income before other income/expense, and Adjusted Pretax Profit as segmented earnings before other income/expense, interest and taxes. Free Cash Flow is calculated as cash provided by operating activities less interest paid less investment in fixed assets net of proceeds of disposal. Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted EPS, pretax profit and Free Cash Flow are used by management, from time to time, to facilitate period-to-period operating comparisons and we believe some investors and analysts use these measures as well when evaluating Exco’s financial performance. These measures, as calculated by Exco, do not have any standardized meaning prescribed by IFRS and are not necessarily comparable to similar measures presented by other issuers. Refer to the table in the Management Discussion and Analysis for a reconciliation of these non-IFRS Measures.

Quarterly Conference Call – April 30, 2020 at 10:00 a.m. (Toronto time):

To access the live audio webcast, please log on to www.excocorp.com, or https://edge.media-server.com/mmc/p/3hyh53ft a few minutes before the event. The conference call can be accessed by dialing toll free at (866) 572-8261 or internationally at (703) 736-7448. The conference ID is 8765498.

For those unable to participate on April 30, 2020, an archived version will be available on the Exco website.

| Source: | Exco Technologies Limited (TSX-XTC) |

| Contact: | Darren Kirk, President & Chief Executive Officer |

| Telephone: | (905) 477-3065, Ext 7233 |

| Website: | https://www.excocorp.com |

About Exco Technologies Limited:

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ about 5,400 people and service a diverse and broad customer base.

Notice To Reader: Forward Looking Statements

Information in this document relating to projected growth and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions and operating efficiencies are forward-looking statements. This press release may contain forward-looking information and forward-looking statements within the meaning of applicable securities laws. We use words such as “anticipate”, “plan”, “may”, “will”, “should”, “expect”, “believe”, “estimate” and similar expressions to identify forward-looking information and statements especially with respect to growth and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions, liquidity and operating efficiencies are forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements throughout this document and are also cautioned that the foregoing list of important factors is not exhaustive. These forward-looking statements are based on our plans, intentions or expectations which are based on, among other things, the current uncertain global economic impact of the COVID-19 pandemic or similar outbreak of epidemic, pandemic, or contagious diseases that may emerge in the human population, which may have a material effect on how we and our customers operate our businesses and the duration and extent to which this will impact our future operating results, assumptions about the number of automobiles produced in North America and Europe, production mix between passenger cars and trucks, the number of extrusion dies required in North America and South America, the rate of economic growth in North America, Europe and emerging market countries, investment by OEMs in drivetrain architecture and other initiatives intended to reduce fuel consumption and/or the weight of automobiles in response to rising climate risks, raw material prices, economic conditions, currency fluctuations, trade restrictions, our ability to close or otherwise dispose of unprofitable operations in a timely manner, our ability to integrate acquisitions and the rate at which our operations in Brazil, and Mexico achieve sustained profitability. These forward-looking statements include known and unknown risks, uncertainties, assumptions and other factors which may cause actual results or achievements to be materially different from those expressed or implied. The Company will update its disclosure upon publication of each fiscal quarter’s financial results and otherwise disclaims any obligations to update publicly or otherwise revise any such factors or any of the forward-looking information or statements contained herein to reflect subsequent information, events or developments, changes in risk factors or otherwise. For a more extensive discussion of Exco’s risks and uncertainties see the ‘Risks and Uncertainties’ section in our latest Annual Report, Annual Information Form (“AIF”) and other reports and securities filings made by the Company. This information is available at www.sedar.com or www.excocorp.com.

TORONTO, April 14, 2020 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX – XTC) today announced that it will report its financial results for the second quarter ended March 31, 2020 after the close of business on Wednesday, April 29, 2020.

A conference call to discuss those results will be held on Thursday, April 30, 2020 at 10:00 a.m. (Eastern time) which can be accessed by dialing toll free at (866) 572-8261 or internationally at (703) 736-7448. The conference ID is 8765498.

To access the live audio webcast, please log on to www.excocorp.com, or https://edge.media-server.com/mmc/p/3hyh53ft a few minutes before the event.

For those unable to participate on April 30, 2020, an archived version will be available until May 5, 2020 on the Exco website or by dialing toll free at (855) 859-2056 or internationally at (404) 537-3406. The conference ID is 8765498.

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ approximately 5,400 people and service a diverse and broad customer base.

| Source: | Exco Technologies Limited (TSX-XTC) |

| Contact: | Darren Kirk, President & Chief Executive Officer |

| Telephone: | (905) 477-3065, Ext 7233 |

| Website: | https://www.excocorp.com |

TORONTO, Feb. 07, 2020 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX: XTC) (“Exco” or the “Company”) today announced that the Toronto Stock Exchange (“TSX”) has approved the Company’s normal course issuer bid (“NCIB”). Under the NCIB, Exco has the right to purchase for cancellation, from February 18, 2020 to February 17, 2021, a maximum of 2,000,000 common shares, representing 8.7% of the 22,866,812 shares forming Exco’s public float as at February 7, 2020. As of February 7, 2020, Exco had 39,936,863 common shares.

Any shares purchased by Exco under the NCIB will be effected through the facilities of TSX as well as on alternative Canadian trading systems, at prevailing market rates and any common shares purchased by the Company will be cancelled. The actual number of shares that may be purchased and the timing of any such purchases will be determined by Exco. Any purchases made by Exco pursuant to the NCIB will be made in accordance with the rules and policies of the TSX.

During the most recently-completed six months, the average daily trading volume for the common shares of Exco on the TSX was 26,236 shares. Consequently, under the policies of the TSX, Exco will have the right to repurchase under its NCIB, during any one trading day, a maximum of 6,559 shares, representing 25% of the average daily trading volume. In addition, Exco will be allowed to make, once per calendar week, a block purchase (as such term is defined in the TSX Company Manual) of shares not directly or indirectly owned by insiders of Exco, in accordance with the TSX policies. Exco will fund the purchases through available cash and/or bank facilities. Pursuant to a previous notice of intention to conduct a normal course issuer bid, under which Company sought and received approval from the TSX to purchase up to 2,100,000 common shares for the period of February 18, 2019 to February 17, 2020, the Company has purchased 1,413,218 common shares on the open market as of February 7, 2020 at a weighted average purchase price of $8.05 per common share.

Exco’s Board of Directors believes the underlying value of the Company may not be reflected in the market price of its common shares from time to time and that, at appropriate times, repurchasing its shares through the NCIB may represent a good use of Exco’s financial resources, as such action can protect and enhance shareholder value when opportunities or volatility arise. Thus, the Board has determined that the NCIB is in the best interest of the Company and its shareholders.

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ 5,400 people and service a diverse and broad customer base.

| Source: | Exco Technologies Limited (TSX-XTC) |

| Contact: | Darren Kirk, President & Chief Executive Officer |

| Telephone: | (905) 477-3065, Ext 7233 |

| Website: | https://www.excocorp.com |

TORONTO, Jan. 30, 2020 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX-XTC) announced voting results from its 2019 annual meeting of shareholders held on January 29, 2020. A total of 26,864,370 Common Shares or 66.84% of our issued and outstanding Common Shares, were voted in connection with the meeting. Shareholders voted by a show of hands in favour of each item of business. Based on proxies received prior to the meeting, each director nominee was elected by a substantial majority as follows:

| Votes For | Votes Withheld/ Against | |

| Edward H. Kernaghan | 98.8% | 1.2% |

| Darren M. Kirk | 99.3% | 0.7% |

| Robert B. Magee | 95.3% | 4.7% |

| Colleen M. McMorrow | 99.6% | 0.4% |

| Paul E. Riganelli | 94.0% | 6.0% |

| Brian A. Robbins | 93.7% | 6.3% |

| Anne Marie Turnbull | 95.4% | 4.6% |

Full results of the votes are included as Appendix A to this press release.

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ approximately 5,400 people and service a diverse and broad customer base.

| Source: | Exco Technologies Limited (TSX-XTC) |

| Contact: | Darren Kirk, President & Chief Executive Officer |

| Telephone: | (905) 477-3065, Ext 7233 |

| Website: | https://www.excocorp.com |

Appendix A

VOTING RESULTS – 2019 ANNUAL MEETING OF SHAREHOLDERS

| Resolution | Votes For | Votes Withheld/Against | ||

| # | % | # | % | |

| Elect Edward H. Kernaghan as Director | 26,314,616 | 98.80% | 307,879 | 1.20% |

| Elect Darren M. Kirk as Director | 26,449,064 | 99.30% | 173,431 | 0.70% |

| Elect Robert B. Magee as Director | 25,376,119 | 95.30% | 1,246,376 | 4.70% |

| Elect Colleen M. McMorrow as Director | 26,528,830 | 99.60% | 93,665 | 0.40% |

| Elect Paul E. Riganelli as Director | 25,023,963 | 94.00% | 1,598,532 | 6.00% |

| Elect Brian A. Robbins as Director | 24,946,619 | 93.70% | 1,675,876 | 6.30% |

| Elect Anne Marie Turnbull as Director | 25,391,690 | 95.40% | 1,230,805 | 4.60% |

| Appointment of Ernst & Young, LLP as Auditors | 25,599,775 | 95.30% | 1,263,521 | 4.70% |

Notes:

(1) Based on proxies submitted

(2) 240,801 shares were not voted

(3) 26,864,370 shares (66.84%) were voted by proxy. 1,074 shares were voted in person at the meeting.

We remain encouraged with our overall results for the year having demonstrated good progress on a number of fronts. While overall industry conditions have clearly softened, our diverse portfolio of businesses remain exceptionally well positioned to capitalize on opportunities we see within our various market niches.

Our exceptional cash generating ability and solid balance sheet remain unquestionably intact. With these characteristics, it can be no surprise that we remain very optimistic about our prospects in the years ahead.

TORONTO, Jan. 29, 2020 (GLOBE NEWSWIRE) — Exco Technologies Limited (TSX-XTC) today announced results for its first quarter of fiscal 2020 ended December 31, 2019. In addition, Exco announced a 6% increase in its quarterly dividend to $0.095 per common share which will be paid on March 30, 2020 to shareholders of record on March 17, 2020. The dividend is an “eligible dividend” in accordance with the Income Tax Act of Canada.

| Three Months ended December 31 | ||

| (in $ millions except per share amounts) | ||

| 2019 | 2018 | |

| Sales | $120.4 | $142.1 |

| Net income for the period | $8.1 | $3.8 |

| Earnings per share | ||

| Basic and Diluted – Reported | $0.20 | $0.09 |

| Adjusted to exclude other income/ expenses | $0.20 | $0.24 |

| Adjusted EBITDA | $15.4 | $18.6 |

“Exco performed well in a challenging environment,” said Darren Kirk, Exco’s President and CEO, adding that, “we are pleased to increase our dividend payment, which signals our confidence in Exco’s ability to continue generating strong levels of free cash flow.”

Consolidated sales for the first quarter ended December 31, 2019 were $120.4 million compared to $142.1 million in the same quarter last year – a decrease of $21.7 million, or 15%. Excluding the impact of the deconsolidation of ALC from Exco’s results in January 2019 and foreign exchange rate movements, revenues were essentially flat.

The Automotive Solutions segment reported sales of $68.3 million in the first quarter – a decrease of $21.1 million, or 24% from the same quarter last year. Of this decrease, $19.8 million was due to the deconsolidation of ALC while foreign exchange rate movements were responsible for an additional $1.5 million of the reduction. Excluding the impact of ALC and foreign exchange rate movements, segment sales were up $0.2 million. This compares very favorably to overall industry vehicle production volumes in North America and Europe, which were lower by roughly 9% during the quarter. Segment sales were supported by a number of program launches for both new and existing products, particularly at Polydesign and AFX. Despite generally softer vehicle industry production levels, management continues to see ample opportunity for future growth. This view is supported by meaningful contract wins during the quarter as well as robust quoting activity for new potential programs across the segment’s various businesses.

The Casting and Extrusion segment reported sales of $52.1 million in the quarter – a decrease of $0.6 million, or 1%, from the same period last year. Excluding foreign exchange rate movements, segment sales were essentially unchanged during the quarter. Within the group, sales were relatively stable in the Large Mould group although quoting activity remains robust with discussions ongoing with both current and new potential customers. Extrusion group sales were modestly higher during the quarter as sales from the new Extrusion facility in Mexico were partially offset by lower sales elsewhere in North America due to softer overall market conditions. At Castool, the group’s revenues were modestly lower as market conditions softened for both consumable and capital equipment goods in the quarter, particularly within the extrusion industry. Within the segment, US steel tariffs continued to reduce during the quarter as certain steel distributors received exemptions of these tariffs during the second quarter of fiscal 2019. As Exco generally aims to pass such tariffs on to its customers, they positively impacted revenues when implemented, but are now having a dampening impact on revenues as they recede.

Consolidated net income for the first quarter was $8.1 million or basic and diluted earnings of $0.20 per share compared to $3.8 million or $0.09 per share in the same quarter last year – an increase in net income of 111%. Excluding a net expense of $6.1 million ($0.15 per share) related to the deconsolidation of ALC in the prior year period, Adjusted Net Income was lower by 19% year over year. The consolidated effective income tax rate for the current quarter was 18% compared to 49% the prior year period. The income tax rate in the current quarter was favorably impacted by the recognition of $0.2 million of deferred tax assets and an increase in earnings in jurisdictions with lower tax rates. As well, the prior year period was unfavorably impacted by the non-deductibility of Other Expense related to the de-consolidation of ALC in the amount of $6.1 million and $2.1 million of operating losses at ALC. Excluding these items, the effective income tax rate for the prior year quarter was 23%.

The Automotive Solutions segment reported pretax profit of $8.0 million in the quarter – a decrease of $1.8 million or 18% over the same quarter last year. Current period results benefited from the elimination of ALC’s operations, which contributed operating losses of $2.1 million the prior year. Segment pretax profits however were nonetheless adversely impacted by higher labor costs, unfavorable product mix, adverse foreign exchange rate movements, the impact of the strike at General Motors and ongoing launch costs inefficiencies, particularly at Polydesign and AFX. To counter ongoing pricing pressures and rising input costs, management remains focused on improving the efficiency of its operations and reducing its overall cost structure. Pricing discipline also remains a focus, although there is typically limited, if any, ability to attain increased pricing for the duration of current programs, which typically range from three to five years. New programs however embed management’s expectations for higher future costs.

The Casting and Extrusion segment reported $4.3 million of pretax profit in the quarter – a decrease of $1.2 million or 22% from the same quarter last year, with much of the variance driven by adverse foreign exchange rate movements. Profitability reduction occurred within the Extrusion group which was impacted by reduced market demand for extrusion dies within North America as well as start-up losses for the Extrusion facility in Mexico. Nonetheless, despite the losses, management remains very encouraged by the early results of its latest facility. As is the case with Exco’s prior greenfield operations, these operations typically require several quarters after production commences to mature and reach sustained profitability. Separately, profitability at the Large Mould group was relatively stable during the quarter. Progress with various efficiency initiatives continues to move ahead however profitability was adversely impacted by reduced overhead absorption at one of the group’s locations due to lower volumes associated with customer timing requirements. Castool’s profitability was down modestly in the quarter due to higher delivery and selling costs as well as reduced overhead absorption and a mix shift towards lower margin products.

The Corporate segment expenses were $2.4 million in the quarter compared to $1.6 million in the prior year quarter. Year over year variances were mainly due to foreign exchange rate movements, which reduced expenses by $0.5 million the prior year and added $0.2 million to expenses the current year period.

Consolidated adjusted EBITDA for the first quarter totaled $15.4 million compared to $18.6 million in the same quarter last year – a decrease of 17%. Adjusted EBITDA as a percentage of sales decreased to 12.8% in the current quarter compared to 13.1% the prior year. The adjusted EBITDA margin in the Casting and Extrusion segment declined to 14.8% from 16.4% last year while the adjusted EBITDA margin in the Automotive Solutions segment increased to 14.5% compared to 12.9% last year.

Operating cash flow before net change in non-cash working capital totaled $13.5 million in the first quarter. After changes in working capital requirements, net cash provided by operating activities amounted to $9.8 million. This cash flow, together with cash on hand was used to fund $0.2 million of interest expense, $6.5 million of capital expenditures, $3.6 million of common dividend payments and $2.7 million of share repurchases. As at December 31, 2020, Exco’s consolidated balance sheet was in a $5.5 million net cash position.

For further information and prior year comparison please refer to the Company’s First Quarter Financial Statements in the Investor Relations section posted at www.excocorp.com. Alternatively, please refer to www.sedar.com.

1 Non-IFRS Measures: In this News Release, reference may be made to Adjusted EBITDA, Adjusted EBITDA Margin, adjusted EPS, adjusted net income, adjusted pretax profit and Free Cash Flow which are not measures of financial performance under International Financial Reporting Standards (“IFRS”). Exco calculates Adjusted EBITDA as earnings before other income/expense, interest, taxes, depreciation and amortization and Adjusted EBITDA Margin as Adjusted EBITDA divided by sales. Exco calculates adjusted EPS as earnings before other income/expense divided by the weighted average number of shares. Adjusted net income is calculated as net income before other income/expense,and adjusted pretax profit as segmented earnings before other income/expense, interest and taxes. Free Cash Flow is calculated as cash provided by operating activities less interest paid less investment in fixed assets net of proceeds of disposal. Adjusted EBITDA, Adjusted EBITDA Margin, adjusted EPS, pretax profit and Free Cash Flow are used by management, from time to time, to facilitate period-to-period operating comparisons and we believe some investors and analysts use these measures as well when evaluating Exco’s financial performance. These measures, as calculated by Exco, do not have any standardized meaning prescribed by IFRS and are not necessarily comparable to similar measures presented by other issuers. Refer to the table in the Management Discussion and Analysis for a reconciliation of these non-IFRS Measures.

Quarterly Conference Call – January 29, 2020 at 4:30 p.m. (Toronto time):

To access the live audio webcast, please log on to www.excocorp.com, or https://edge.media-server.com/mmc/p/8pdaxvhn a few minutes before the event. The conference call can be accessed by dialing toll free at (866) 572-8261 or internationally at (703) 736-7448. The conference ID is 7885506. Questions can be submitted via the Q&A box on the webcast console or via the conference call.

For those unable to participate on January 29, 2020, an archived version will be available on the Exco website.

| Source: | Exco Technologies Limited (TSX-XTC) |

| Contact: | Darren Kirk, President & Chief Executive Officer |

| Telephone: | (905) 477-3065, Ext 7233 |

| Website: | https://www.excocorp.com |

About Exco Technologies Limited:

Exco Technologies Limited is a global supplier of innovative technologies servicing the die-cast, extrusion and automotive industries. Through our 15 strategic locations in 7 countries, we employ about 5,400 people and service a diverse and broad customer base.

Notice To Reader: Forward Looking Statements

Information in this document relating to projected growth and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions and operating efficiencies are forward-looking statements.

This press release may contain forward-looking information and forward-looking statements within the meaning of applicable securities laws. We use words such as “anticipate”, “plan”, “may”, “will”, “should”, “expect”, “believe”, “estimate” and similar expressions to identify forward-looking information and statements especially with respect to growth and financial performance of the Company’s business units, contribution of our start-up business units, contribution of awarded programs yet to be launched, margin performance, financial performance of acquisitions and operating efficiencies are forward-looking statements. Readers are cautioned not to place undue reliance on forward-looking statements throughout this document and are also cautioned that the foregoing list of important factors is not exhaustive. These forward-looking statements are based on our plans, intentions or expectations which are based on, among other things, assumptions about the number of automobiles produced in North America and Europe, production mix between passenger cars and trucks, the number of extrusion dies required in North America and South America, the rate of economic growth in North America, Europe and emerging market countries, investment by OEMs in drivetrain architecture and other initiatives intended to reduce fuel consumption and/or the weight of automobiles in response to rising climate risks, raw material prices, economic conditions, currency fluctuations, trade restrictions, our ability to close or otherwise dispose of unprofitable operations in a timely manner, our ability to integrate acquisitions and the rate at which our operations in Brazil, and Mexico achieve sustained profitability. These forward-looking statements include known and unknown risks, uncertainties, assumptions and other factors which may cause actual results or achievements to be materially different from those expressed or implied. The Company will update its disclosure upon publication of each fiscal quarter’s financial results and otherwise disclaims any obligations to update publicly or otherwise revise any such factors or any of the forward-looking information or statements contained herein to reflect subsequent information, events or developments, changes in risk factors or otherwise. For a more extensive discussion of Exco’s risks and uncertainties see the ‘Risks and Uncertainties’ section in our latest Annual Report, Annual Information Form (“AIF”) and other reports and securities filings made by the Company. This information is available at www.sedar.com or www.excocorp.com.